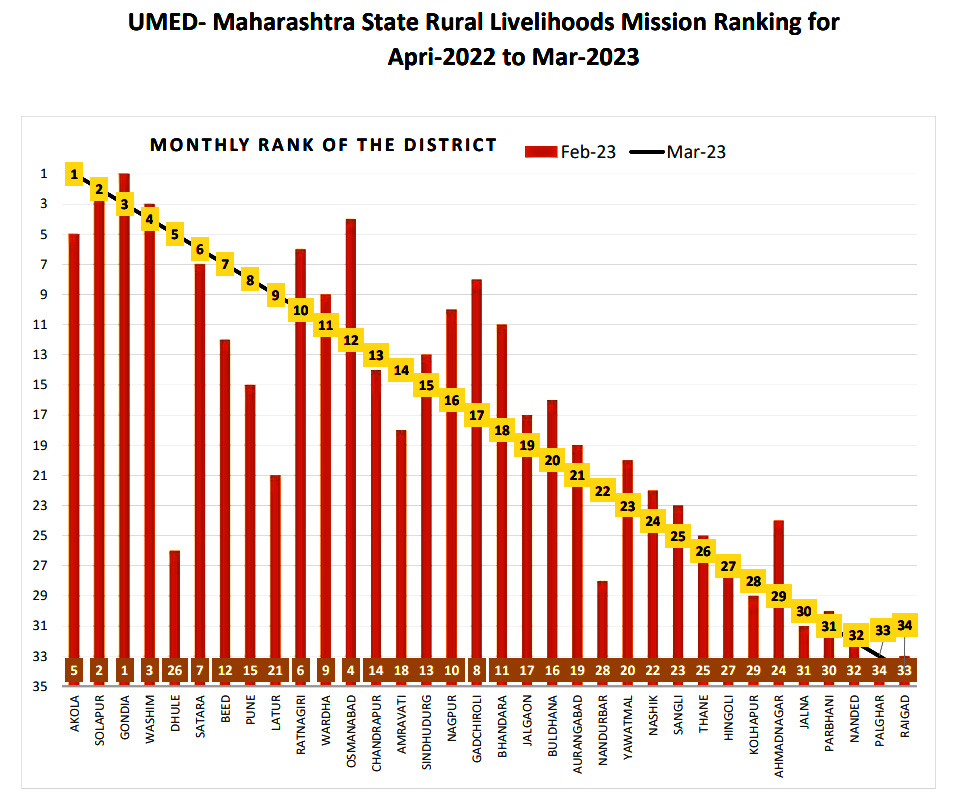

महाराष्ट्र राज्य ग्रामीण जीवनोन्नती अभियान

राज्यातील ग्रामीण भागातील गरीबीचे निर्मुलन करण्यासाठी केंद्र शासनाने राष्ट्रीय ग्रामीण जीवन्नोंनती अभियानाची सुरुवात सन २०११ मध्ये केली. महाराष्ट्र राज्यात सदरील अभियानाची अंमलबजावणी करण्यासाठी मा. मुख्यमंत्री यांच्या अध्यक्षतेखाली ग्रामविकास विभांगांतर्गत महाराष्ट्र राज्य ग्रामीण जीवन्नोंनती अभियान या स्वतंत्र संस्थेची स्थापना संस्था नोंदणी अधिनियम १८६० अन्वये करण्यात आलेली आहे. सदरील अभियानाची अंमलबजावणी राज्यातील ३४ जिल्हे व ३५१ तालुक्यातील पुर्ण ताकदीने अभियान राबविले जात आहे.

महाराष्ट्र राज्यातील ७१ लक्ष गरीब कुटुंबांना शाश्वत उपजीविकेच्या माध्यमातून गरिबीतून बाहेर काढण्यासाठी अभियान कटीबद्ध आहे. या करीता समुदाय संघटन, गरिबांच्या गरीबांनी निर्माण केलेल्या बळकट समुदायस्तरीय संस्थांची निर्मिती, विविध पथदर्शी प्रकल्प, स्वयंसेवी व शासकीय तसेच खाजगी संस्थासोबत भागीदारी अद्यावत मनुष्यबळ संसाधन विकास पद्धती, शाश्वात उपजीविकेचे स्तोत्र उभे करण्याकरिता अभियानामार्फत तसेच विविध वित्तय संस्था व बँकांच्या माध्यमातून वेळेवर, किफायत व्याज दराने व नियमित वित्त पुरवठा, कृतीसंगमांच्या माध्यमातून विविध शासकिय योजनांचा गरीब कुटुंबांना लाभ मिळविण्याकरिता समुदायस्तरीय संस्थांची क्षमता बांधणी करणे, अशा अनेक नाविन्यपूर्ण व परिणामकारण पद्धतीने अभियानाची अंमलबजावणी राज्यात करण्यात येत आहे.

अधिक माहिती...

Search ForOur Courses

Fill The Below Form and Star Searching

उमेद मार्ट

उमेद मार्ट बीसी सखी

बीसी सखी